Why are global stock markets plunging?

Europe, Asia and Wall Street have all suffered big falls after US economy data spooked investors

Global stock markets have tumbled this week in a scare first sparked by fears the US economy is heading for a recession.

New data released at the end of last week suggested the US economy has significantly slowed, and the days following have seen a "global rout" in stock markets that has fuelled fears of a full-blown crash, said The Telegraph.

With European markets opening "in the red" and the FTSE 100 experiencing its "worst drop in more than a year", no market seemed immune from the spiral, the newspaper added. It is thought the global sell-off has "wiped trillions of dollars off of global markets", said the Daily Express. The effect appears most severe in Japan's Nikkei index, which suffered "its worst day since 1987 and hitting a seven-month low".

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What did the commentators say?

Global market drops can be attributed to the latest US jobs report showing unemployment "rising to its highest level in years", said The New York Times. The figures stoked fears the "economy was cooling", prompting a wave of "investor anxiety".

Investors were already on a knife-edge thanks to the US Federal Reserve's "waiting game" on lowering its benchmark interest rate, said Bloomberg's John Authers. "To err is human", but the Fed might have held off "too long", creating an atmosphere of "hair-trigger reactions to every shred of news".

A "painful combination of factors", such as a potential recession in the US and the current geopolitical tensions, have damaged the "global risk appetite of investors", said the Financial Times' Leo Lewis. Donald Trump was quick to blame the slide on the Democrats, calling Joe Biden "sound asleep" on the economy and claiming Kamala Harris "doesn't have a clue".

Despite the fears being rooted in the US economic outlook, it is Japan that has seemingly borne the brunt of the ongoing crisis. The painful irony is that the Nikkei has "recently been experiencing a renaissance", said Lewis, meaning it is "unusually attractive to take profits from it right now because the gains this year have been so good".

Not everyone is buying into the idea of a worst-case scenario. "We don't see a recession [in the US] even though the stock market today is behaving like it anticipates a recession," Nancy Vanden Houten, lead economist at Oxford Economics, told Al Jazeera. There are "things going on beneath the surface" of the seemingly glum data, she said – the higher unemployment rate, for instance, is partly due to new immigrants entering the workforce, and "that is a good thing".

What next?

With a global sell-off now in full swing, the prospects of swift interest rate cuts by the US Federal Reserve at its next meeting on 17 September "loom large", said Reuters.

While Britain's FTSE 100 has undoubtedly been caught up in the ongoing "global mayhem", it could be in with a chance of "skirting the absolute worst of the declines". As sectors within the index often offer a glut of "solid, predictable dividends", investors will be turning to the FTSE to ensure safety, Bloomberg added.

Meanwhile, it will be a "moment of truth" for Japan's stock market, said Reuters' Una Galan, as this week's "slump" is likely to finally reveal "how much substance is beneath the froth" in the country.

Problems are unlikely to end soon. In fact, "we likely have a summer of volatility ahead of us", said Chris Beauchamp, chief market analyst at online trading platform IG, in The Mirror, as "such moves don't stop in a single day".

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Rebekah Evans joined The Week as newsletter editor in 2023 and has written on subjects ranging from Ukraine and Afghanistan to fast fashion and "brotox". She started her career at Reach plc, where she cut her teeth on news, before pivoting into personal finance at the height of the pandemic and cost-of-living crisis. Social affairs is another of her passions, and she has interviewed people from across the world and from all walks of life. Rebekah completed an NCTJ with the Press Association and has written for publications including The Guardian, The Week magazine, the Press Association and local newspapers.

-

The week's best photos

The week's best photosA helping hand, a rare dolphin and more

By Anahi Valenzuela, The Week US Published

-

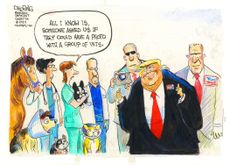

Today's political cartoons - August 30, 2024

Today's political cartoons - August 30, 2024Cartoons Friday's cartoons - seasoned vets, football season, and more

By The Week US Published

-

'Harris gains slim lead'

'Harris gains slim lead'Today's Newspapers A roundup of the headlines from the US front pages

By The Week Staff Published

-

US job growth revised downward

US job growth revised downwardSpeed Read The US economy added 818,000 fewer jobs than first reported

By Peter Weber, The Week US Published

-

Can Starbucks' new CEO revive the company?

Can Starbucks' new CEO revive the company?Today's Big Question Brian Niccol has been the CEO of Chipotle since 2018 but is now moving to the coffee chain

By Justin Klawans, The Week US Published

-

US inflation drops below 3%, teeing up rate cuts

US inflation drops below 3%, teeing up rate cutsSpeed Read This solidifies expectations that the Federal Reserve will finally cut interest rates in September

By Peter Weber, The Week US Published

-

Is the Fed ready to start cutting interest rates?

Is the Fed ready to start cutting interest rates?Today's Big Question Recession fears and a presidential election affect the calculation

By Joel Mathis, The Week US Published

-

Will Keir Starmer scrap the two-child benefit cap?

Will Keir Starmer scrap the two-child benefit cap?Today's Big Question PM signals 'change in tone' as Labour rebels prepare to back amendment calling for immediate end to controversial 'social cleansing' policy

By The Week UK Published

-

Why can't China turn its economy around?

Why can't China turn its economy around?Today's Big Question The post-pandemic crisis puts pressure on Communist Party leaders

By Joel Mathis, The Week US Published

-

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down

By Joel Mathis, The Week US Published

-

The precipitous fall of the Japanese yen

The precipitous fall of the Japanese yenUnder the Radar The Yen recently below 160 to the dollar, its lowest value in more than 30 years

By Justin Klawans, The Week US Published