When is the best time of year to buy a car? For new cars, it's coming up.

There are certain times within the month or even on certain days of the week that can help you score a more competitive deal

It turns out that some times are better than others to buy a car. Even though there are often sales on vehicles throughout the year, especially around Memorial Day and Labor Day, the final few months of the year — think October to December — is the real sweet spot for buying.

This is because "new models are typically released in the fall of the preceding year," said The Wall Street Journal.

But you can get the timing even more dialed in. There are certain times within the month and even particular days of the week when you can score a more competitive deal.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

When can you get the best deal on a car?

As mentioned, October through December is generally the best time to purchase a car. But if you "want to get the best deal, you might want to wait until December, even though you'll run the risk of having fewer cars to choose from," said Edmunds.

If you don't want to hold out until December, you might at least try to wait until the month's end. That's because "you're likely to find competitive car-buying deals toward the last week of any month or quarter," since "this is when car salespeople are more motivated to slash sticker prices even if it means they'll get lower commissions," said MarketWatch.

As for which day of the week you should go in, "Monday is usually the best day of the week to buy a car" since "showrooms will be the least busy," said MarketWatch. However, Tuesday or Wednesday can also be a good bet, especially in areas where dealerships aren't open on Sundays, said Edmunds.

Does the same timing apply for buying a used car?

In short, yes. The months of October through December are also the months that "coincide with the peak new-car buying season at the dealership, which means more trade-ins are entering the used car inventory," said Edmunds. This in turn means a "better selection of used cars — and better prices, especially if the dealership is trying to hit its end-of-year quota." Just like with a new car, if you're really focused on trying to get the best deal possible, then "you'll want to shop in December."

Another "sweet spot" for used car buyers is from early April to early May, said the Journal, because "when people get their tax refund back in the spring, a lot of them go car shopping." This can lead dealerships to "compete for customers by offering deals."

Are some years better than others for buying?

The question of whether this year is a good year to buy a car may also come to mind, especially after the pandemic. "Throughout 2021, new and used car prices rose steeply as consumers felt the impacts of COVID-19 and microchip shortages," said MarketWatch.

So, should you take the leap now, or are you better off waiting for the new year? There are a few factors to take into consideration when making this decision.

For starters, you will want to take a look at average vehicle costs. "You can search for industry reports" or "use car value estimators from resources like Kelley Blue Book or Edmunds" to research "your desired car model and compare the value online to the prices you see from dealerships," said MarketWatch. In the instance you "notice a large markup, it's probably not a good time to buy a car."

Another factor to pay attention to is average auto loan rates, if you are planning to borrow money to help fund your car purchase. While it is hard to know for sure, you generally can get a sense of "how average loan rates have been moving," said MarketWatch. For instance, with the Federal Reserve poised to make interest rate cuts in fall 2024, "that might be a reason to wait on shopping for a new car," said Kelley Blue Book. Just keep in mind it may take a little while to feel the effects of those rate cuts, meaning they "might not reach car loan applicants until the end of the year."

And lastly, take a look at your own credit score, as this "has a huge impact on the interest rates and loan options lenders offer you," said MarketWatch. If your score is not quite where you would like it to be, consider taking some time to work to improve it — that effort could save you in the long run.

How else can you score car-buying savings?

Of course, timing isn't everything when it comes to buying a car. Other tips to keep in mind as you set out to purchase a vehicle include:

Get pre-approved before you start shopping. Before you enter a car dealership, get pre-approved for a car loan. This can help you understand how much you can afford to spend on a car and whether your credit needs improvement, said NPR. Further, by getting pre-approved, you'll have more leverage to negotiate a better rate on your loan.

Do your research. It's also smart to gather lots of information, both on vehicles and their features as well as the fair market value and average selling price, which you can find in sources like Kelley Blue Book. "When car dealers know you've done your homework, they are more likely to offer their best deal first," said GoBankingRates.

Comparison shop at different dealerships. On a similar note, it's helpful to shop around and compare what different dealerships can offer. One approach here is to "call, text or email the internet sales department of three dealerships that have the car you want" and "ask each for the total selling price, including any additional accessories that may have already been installed on the car," said Edmunds. From there, you can take the best offer or bring it to the other dealerships to see if they'll do even better.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

The week's best photos

The week's best photosA helping hand, a rare dolphin and more

By Anahi Valenzuela, The Week US Published

-

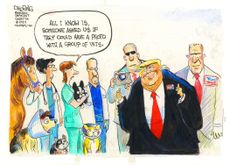

Today's political cartoons - August 30, 2024

Today's political cartoons - August 30, 2024Cartoons Friday's cartoons - seasoned vets, football season, and more

By The Week US Published

-

'Harris gains slim lead'

'Harris gains slim lead'Today's Newspapers A roundup of the headlines from the US front pages

By The Week Staff Published

-

A beginner's guide to passive income

A beginner's guide to passive incomeThe Explainer Smart ideas for making money with low-maintenance investments

By Becca Stanek, The Week US Published

-

When will America's rental prices come down?

When will America's rental prices come down?feature Things may finally be cooling off

By Becca Stanek, The Week US Published

-

4 tips to keep your emotions out of investing

4 tips to keep your emotions out of investingThe explainer It's normal to feel worried about dips in stock prices or excited about an investment opportunity — but do not let it cloud your judgement

By Becca Stanek, The Week US Published

-

What is early direct deposit and how does it work?

What is early direct deposit and how does it work?The explainer Next time you are in a financial pinch, this option can get you early access to your paycheck

By Becca Stanek, The Week US Published

-

When does it make sense to refinance your mortgage?

When does it make sense to refinance your mortgage?The explainer You may be able to secure a lower interest rate — but it's not a good move for everyone

By Becca Stanek, The Week US Published

-

Are you entitled to compensation if your flight is delayed or canceled?

Are you entitled to compensation if your flight is delayed or canceled?The explainer New rules will soon require airlines to issue automatic refunds for canceled flights

By Becca Stanek, The Week US Published

-

How can students and young people start building credit?

How can students and young people start building credit?the explainer Young adults usually don't have a credit score — but there are several ways they can begin to build credit in preparation for their financial future

By Becca Stanek, The Week US Published

-

5 tips to save on back-to-school shopping

5 tips to save on back-to-school shoppingThe Explainer Kids will soon be heading back to school, which can mean a major shopping bill for parents

By Becca Stanek, The Week US Published