What is the best way to use your tax refund?

It may be tempting to splurge — but there are smarter places to put that money

If you're owed a tax refund and it hasn't already arrived, it's bound to hit your bank account (or mailbox) sometime soon. As of mid-March, the average refund amount that taxpayers are receiving this tax season is $3,109, said The Wall Street Journal.

Given this is far from an insignificant chunk of change, it's helpful to have a plan in place for how to use it. While treating yourself to a vacation or retail purchase is an option — in fact, said CNBC Make It, "about 20% of taxpayers plan to use the cash for fun expenses" — it's not necessarily the choice that's going to offer the best bang for your buck.

Here are some other options you might consider that can provide some longer-term payoffs when it comes to your overall financial health.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Build your emergency fund

By allocating even just a portion of your tax refund toward your emergency fund, you will end up in better shape when the unexpected happens, whether that's a costly car repair or an unanticipated layoff.

Experts generally recommend stashing your emergency fund with at least "three to six months of expenses," said U.S. News & World Report. But if that doesn't seem like a possibility with your usual paychecks, then "you can use your tax refund to boost that number."

Pay off high-interest debt

"Households were holding a record $17.5 trillion in debt last year, including record sums tied to their credit cards and vehicles," said the Journal, citing the Federal Reserve. This tax season, many plan to tap their tax refunds to help pay down that debt. In fact, an estimated "one in five Americans plan to use most of their tax refund to pay down debt this year," said the Journal, citing Bankrate.

Not only can paying down debt eliminate (or at least reduce) your balance, it can have a cascade of other positive financial effects as well. For instance, said Experian, paying down credit card debt can also allow you to "save money on interest charges," "improve your credit score by reducing credit utilization," and "free up available credit so you have it in an emergency."

Cover necessary repairs and maintenance

If you have your emergency fund well-stocked and your debt paid down (hats off to you), you might consider using your tax refund to tackle necessary maintenance or upgrades for your home or vehicle.

"Think about any big expenses that are likely to come up in the next 12 months and get in front of them. For instance, if your tires are balding or your dryer is making noises, use your tax refund to upgrade. Then you get the joy of spending some money and you also avoid a future financial crisis," Charlie Corsello Jr., the president and founder of TaxCure, said to U.S. News & World Report.

As an added bonus, this sort of spending can end up benefiting you in the long run. "Using your tax refund to maintain or improve your home can be a good investment in your home's value," said Experian, just as keeping your car "in good running order" can mean "you'll save money on repairs over the long haul."

Contribute to a Roth IRA or 401(k)

Still searching for ways to use your tax refund? Saving it for your retirement is almost always a smart way to go. While "contributing to any tax-advantaged retirement account is an excellent use of your tax refund," said Experian, "refund time can be an especially good moment to consider a Roth IRA or Roth 401(k)."

For one, Roth accounts offer "flexibility," as "if you need to withdraw your original Roth contributions before you reach retirement age, you can do so without tax penalty," said Experian. Further, there's the potential for some tax savings, too, since "money in a Roth account grows tax free," and "when you withdraw your money in retirement, your distributions are also tax-free, unlike withdrawals from a traditional IRA."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

The week's best photos

The week's best photosA helping hand, a rare dolphin and more

By Anahi Valenzuela, The Week US Published

-

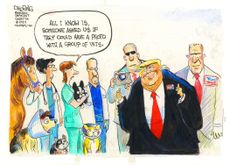

Today's political cartoons - August 30, 2024

Today's political cartoons - August 30, 2024Cartoons Friday's cartoons - seasoned vets, football season, and more

By The Week US Published

-

'Harris gains slim lead'

'Harris gains slim lead'Today's Newspapers A roundup of the headlines from the US front pages

By The Week Staff Published

-

A beginner's guide to passive income

A beginner's guide to passive incomeThe Explainer Smart ideas for making money with low-maintenance investments

By Becca Stanek, The Week US Published

-

The financial impact of returning to work in later life – should you 'unretire'?

The financial impact of returning to work in later life – should you 'unretire'?The Explainer Many people return to the workplace after retirement age, but what could it mean for your finances?

By Marc Shoffman, The Week UK Published

-

When will America's rental prices come down?

When will America's rental prices come down?feature Things may finally be cooling off

By Becca Stanek, The Week US Published

-

When is the best time of year to buy a car? For new cars, it's coming up.

When is the best time of year to buy a car? For new cars, it's coming up.The Explainer There are certain times within the month or even on certain days of the week that can help you score a more competitive deal

By Becca Stanek, The Week US Published

-

4 tips to keep your emotions out of investing

4 tips to keep your emotions out of investingThe explainer It's normal to feel worried about dips in stock prices or excited about an investment opportunity — but do not let it cloud your judgement

By Becca Stanek, The Week US Published

-

What is early direct deposit and how does it work?

What is early direct deposit and how does it work?The explainer Next time you are in a financial pinch, this option can get you early access to your paycheck

By Becca Stanek, The Week US Published

-

When does it make sense to refinance your mortgage?

When does it make sense to refinance your mortgage?The explainer You may be able to secure a lower interest rate — but it's not a good move for everyone

By Becca Stanek, The Week US Published

-

Are you entitled to compensation if your flight is delayed or canceled?

Are you entitled to compensation if your flight is delayed or canceled?The explainer New rules will soon require airlines to issue automatic refunds for canceled flights

By Becca Stanek, The Week US Published