The precipitous fall of the Japanese yen

The Yen recently below 160 to the dollar, its lowest value in more than 30 years

Japan's economy has not had a good 2024, to say the least. It entered a short recession in February and now is dealing with a crisis surrounding the nation's currency, the yen. The currency's exchange rate has been seeing a continuous slide, recently weakening to 160.86 against the U.S. dollar and 171.79 against the euro. This marks the yen's lowest value against the dollar since 1986, and its lowest value against the euro ever.

This unprecedented low values had some wondering how other nations would react to the ongoing issues within Japan's economy — specifically whether or not foreign markets would intervene in an attempt to stop the slide. How did Japan's currency get here, and why are many industry experts blaming the United States?

Why is the yen losing value?

There are several factors, but it is mainly a "product of divergent monetary policy between the Bank of Japan and its developed-market peers — particularly the Federal Reserve," said Barron's. This is the result of a wide difference in interest rates between the U.S. and Japan; the Bank of Japan "has only just begun to ease off intense monetary stimulus, while the Fed and other central banks are years into tightening cycles."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Bank of Japan has attempted to "normalize monetary policy" by "lifting its benchmark interest rate out of negative territory," said Barron's. But these efforts have been "dwarfed by the Fed's interest-rate hikes starting in 2022," and this "wide gap sets up a popular so-called carry trade for Japanese investors and institutions that puts pressure on the yen."

This interest rate gap "reflects the very different inflation environments in the U.S. and Japan," said Al Jazeera. Japan has "struggled to get prices and wages to rise after decades of economic stagnation" while the U.S. "has been battling to bring prices down amid robust economic growth." This has made Japan one of few countries that has "maintained rock-bottom borrowing costs in an effort to shake the economy out of a prolonged stagnation known as 'the lost decades.'" But the trend is not entirely new; The currency "has been on a continual slide since early 2021" and "over the last three years, the yen has lost more than one-third of its value."

How can the yen be saved?

The "grim reality" is that the "slide won't stop until the Federal Reserve relents on its higher-for-longer policy path. And [Japanese officials] have no control over that," said Bloomberg. Beyond this, all "efforts by officials in Tokyo to prop up the yen so far have fallen flat."

Japan has said it will take the required actions to stop the yen's bleeding. It is "desirable for exchange rates to move stably. Rapid, one-sided moves are undesirable. In particular, we're deeply concerned about the effect on the economy," Japanese Finance Minister Shunichi Suzuki said, per Reuters. The government is "watching moves with a high sense of urgency, analyzing the factors behind the moves, and will take necessary actions."

But there are doubts as to whether any actions "can reverse the weak-yen tide that is driven mostly by uncertainty over how soon the U.S. Federal Reserve will start cutting interest rates," said Reuters. While the Bank of Japan has signaled that it will likely raise interest rates, an "increase in the current near-zero short-term policy target will still keep Japan's borrowing costs very low," meaning the yen would remain mostly stagnant.

And any small rate hikes are "unlikely to satisfy the market and intervention now is pretty much the only option for Japan to slow down the weakening," Tsuyoshi Ueno, an economist at NLI Research Institute, said to The Japan Times. But not all the news is bad. If inflation continues falling in the United States, it "could very quickly change the outlook for the interest rate gap between the dollar and the yen, and the Japanese currency could make a dramatic comeback," said the outlet.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Justin Klawans has worked as a staff writer at The Week since 2022. He began his career covering local news before joining Newsweek as a breaking news reporter, where he wrote about politics, national and global affairs, business, crime, sports, film, television and other Hollywood news. Justin has also freelanced for outlets including Collider and United Press International.

-

The week's best photos

The week's best photosA helping hand, a rare dolphin and more

By Anahi Valenzuela, The Week US Published

-

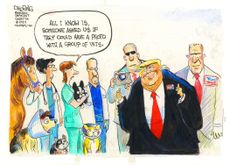

Today's political cartoons - August 30, 2024

Today's political cartoons - August 30, 2024Cartoons Friday's cartoons - seasoned vets, football season, and more

By The Week US Published

-

'Harris gains slim lead'

'Harris gains slim lead'Today's Newspapers A roundup of the headlines from the US front pages

By The Week Staff Published

-

Luxe landlords: High-end brands are moving into real estate

Luxe landlords: High-end brands are moving into real estateUnder the Radar Luxury brands are investing in both commercial and residential property.

By Justin Klawans, The Week US Published

-

Can Starbucks' new CEO revive the company?

Can Starbucks' new CEO revive the company?Today's Big Question Brian Niccol has been the CEO of Chipotle since 2018 but is now moving to the coffee chain

By Justin Klawans, The Week US Published

-

Is the Fed ready to start cutting interest rates?

Is the Fed ready to start cutting interest rates?Today's Big Question Recession fears and a presidential election affect the calculation

By Joel Mathis, The Week US Published

-

Western brands under pressure from Middle East boycotts

Western brands under pressure from Middle East boycottsIn the Spotlight Across the Middle East, consumers are "shunning" Western brands over their perceived stance on Israel-Gaza conflict

By The Week Staff Published

-

Why are global stock markets plunging?

Why are global stock markets plunging?Today's Big Question Europe, Asia and Wall Street have all suffered big falls after US economy data spooked investors

By Rebekah Evans, The Week UK Published

-

The inconvenience store: Why are shops locking up even more merchandise?

The inconvenience store: Why are shops locking up even more merchandise?Under the Radar You may have noticed a surge in items stowed behind security glass

By Anya Jaremko-Greenwold, The Week US Published

-

Would Trump's tariff proposals lift the US economy or break it?

Would Trump's tariff proposals lift the US economy or break it?Talking Points Economists say fees would raise prices for American families

By Joel Mathis, The Week US Published

-

Will the housing slump ever end?

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down

By Joel Mathis, The Week US Published