The pros and cons of buying a fixer-upper

Does it make sense to buy a home in need of a little TLC?

As the cost of buying a home continues to soar, the fixer-upper is gaining appeal. With about one in five Gen Zers saying a "lack of affordable starter homes poses a barrier towards homeownership," more than half — 57% — "are willing to put an offer in on a fixer-upper," said CNBC, citing a new report by Clever Real Estate.

A fixer-upper is defined as being "available at a lower purchase price," said Rocket Mortgage, but that's "because it requires major maintenance work once you buy the house." So, is it worth getting a lower purchase price in exchange for all of that work and investment down the road? Here's what to consider.

What are the upsides of buying a fixer-upper?

We'll focus on the positives first — and there are certainly some pros to opting for a fixer-upper over a house that's move-in ready. The pros:

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A lower purchase price. "Fixer-uppers cost less per square foot than move-in ready homes," which can mean "both your down payment and your monthly mortgage payment are lower," said Money Crashers. In turn, this "makes it easier to afford a home, or to get a bigger house than your budget would allow otherwise."

Fewer buyers to compete against. Another upside? There will be less competing buyers than you may find on more move-in ready homes. "Generally speaking, you'll find less competition for fixer-upper homes," said Rocket Mortgage.

An opportunity to customize the home. "When you redo a house from the ground up, you can make it just the way you want it," said Money Crashers. While you may hesitate to undo a house that's already in good shape, you will need to do that work in a fixer-upper, offering you the chance to make exactly the choices you want.

What are the drawbacks?

Of course, there are plenty of downsides to buying a fixer-upper as well. The cons:

Cost of repairs and renovations: While you are saving on purchase price, you will have to pay for the repairs and renovations the home needs. And "depending on the renovations, you may end up barely breaking even — or spending more money on a fixer-upper," said Rocket Mortgage.

Reality of coordinating and living in construction: "For a fixer-upper that needs a lot of work, you'll likely have to begin planning your renovation in advance," said U.S. News & World Report. Plus, you will either need to find elsewhere to live while work is getting done or deal with living in a noisy construction zone for a period of time.

Possibility of surprise issues: Even the best-laid plans can go awry, especially when it comes to "older houses," which "often have hidden problems a home inspection doesn't reveal," said Money Crashers. This can make it "hard to come up with an accurate renovation budget ahead of time."

What should you consider before purchasing a fixer-upper?

Before you commit yourself to the challenge of a fixer-upper, there are a few tips to keep in mind:

Make sure the home you choose is in a desirable location. While there is a lot that you can change about a fixer-upper, one thing you cannot change is the home's location. As such, aim to find a fixer-upper that "is in a desirable neighborhood that you love," said Bankrate. Otherwise, "if you dislike your surroundings or property values are struggling in the area, you might be left with buyer's remorse."

Always get a thorough home inspection. A home inspection is always important when purchasing a home, but it is particularly critical when buying a fixer-upper. For the inspection, "focus on the major components of a home so you can anticipate how much you might need to budget for serious structural or functionality repairs," said Bankrate. Specifically, this includes the house's roof and foundation, AC and HVAC systems, and plumbing, electricity and sewer systems.

Know how much time and money you can realistically offer. While you might save on the purchase price with a fixer-upper, you can expect to shell out for renovations along the way. Part of this budgeting equation involves whether you can do some of the work on the house yourself and if so, how much of your own time you are willing to invest.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

Israel, UN agree to Gaza pauses for polio vaccinations

Israel, UN agree to Gaza pauses for polio vaccinationsSpeed Read Gaza's first case of polio in 25 years was confirmed last week in a 10-month-old boy who is now partially paralyzed

By Rafi Schwartz, The Week US Published

-

The week's best photos

The week's best photosA helping hand, a rare dolphin and more

By Anahi Valenzuela, The Week US Published

-

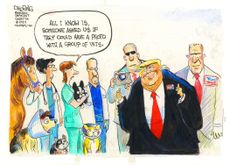

Today's political cartoons - August 30, 2024

Today's political cartoons - August 30, 2024Cartoons Friday's cartoons - seasoned vets, football season, and more

By The Week US Published

-

A beginner's guide to passive income

A beginner's guide to passive incomeThe Explainer Smart ideas for making money with low-maintenance investments

By Becca Stanek, The Week US Published

-

When will America's rental prices come down?

When will America's rental prices come down?feature Things may finally be cooling off

By Becca Stanek, The Week US Published

-

When is the best time of year to buy a car? For new cars, it's coming up.

When is the best time of year to buy a car? For new cars, it's coming up.The Explainer There are certain times within the month or even on certain days of the week that can help you score a more competitive deal

By Becca Stanek, The Week US Published

-

4 tips to keep your emotions out of investing

4 tips to keep your emotions out of investingThe explainer It's normal to feel worried about dips in stock prices or excited about an investment opportunity — but do not let it cloud your judgement

By Becca Stanek, The Week US Published

-

What is early direct deposit and how does it work?

What is early direct deposit and how does it work?The explainer Next time you are in a financial pinch, this option can get you early access to your paycheck

By Becca Stanek, The Week US Published

-

When does it make sense to refinance your mortgage?

When does it make sense to refinance your mortgage?The explainer You may be able to secure a lower interest rate — but it's not a good move for everyone

By Becca Stanek, The Week US Published

-

Are you entitled to compensation if your flight is delayed or canceled?

Are you entitled to compensation if your flight is delayed or canceled?The explainer New rules will soon require airlines to issue automatic refunds for canceled flights

By Becca Stanek, The Week US Published

-

How can students and young people start building credit?

How can students and young people start building credit?the explainer Young adults usually don't have a credit score — but there are several ways they can begin to build credit in preparation for their financial future

By Becca Stanek, The Week US Published