The midyear financial check-in: why it matters and what to review

This year is halfway over. Have you checked your finances?

Believe it or not, the year is already halfway over. While you may currently be swept up in summer barbecues and beach vacations, the year's midway point is also a great time to check in on those financial goals you set for yourself at the start of the new year.

Maybe checking in will give you a reason to pat yourself on the back for all the hard work you have done so far on your finances. But don't worry if that is not quite the case — you still have half the year to go to make up for lost time.

Why is it worth doing?

"Regular attention to your personal finances is crucial in following your budget and saving money for emergencies, retirement and other life goals," said Bankrate, and "the middle of the year is a good time to take stock of how things are going."

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If you set financial goals for yourself but then do not routinely check back in, you will not know whether or not you're actually moving in the right direction. Maybe you will realize that you have sailed past a goal you thought would take the full year to hit — in which case, you could consider upping the ante. Or maybe, you will notice you have veered off track or barely inched forward, which may prompt you to reevaluate how realistic the goal really was in the first place or decide to shift your habits for the remainder of the year.

What should you review?

So, what exactly should you look over in your midyear check-in? Here are some areas to inspect:

Your budget: Your midyear review is a great chance to "make sure you're staying on track with your saving, spending and income goals," said Equifax. To get a sense of your spending habits, "start by reviewing your credit card and bank statements," dividing your spending "into categories such as rent, utilities, food, health and entertainment."

Do not hesitate to make adjustments as necessary, especially if you "identify areas where you're spending more or less than expected," said Bankrate. If you find you are overspending in certain areas, consider "whether to allocate more money to them or find ways to cut your spending." Also look at any debt you have and consider whether you can work more room into your budget to expedite paying that down.

Your emergency fund: As you review your budget, also take a look at your savings habits. "Ideally, you should have three to six months of living expenses saved in an emergency fund," so "if you dipped into that account to pay for car or home repairs or another unexpected expense, now is the time to figure out how you can turbocharge your savings — or at least get back to a regular savings strategy," said CNBC.

Your credit report and credit score: "Checking your credit reports a couple of times a year is a good financial habit," said Equifax, and the year's midpoint is a natural time to do so. Plan to "pull your credit reports from the three main credit bureaus: Equifax, Experian and TransUnion," and "make sure personal information, such as your name and address, is correct," said NerdWallet. Also look out for any errors or issues, and be sure to "review the accounts and credit inquiries listed on your reports too."

Note that you "won't see credit scores on your credit reports, but you can get them elsewhere for free," said NerdWallet. Your credit score is particularly worth checking if you're "planning a big purchase, such as a car or home," in the remaining months of the year.

Your retirement savings: Especially if "your income has fluctuated this year, your capacity for retirement savings may have changed along with it," said Bankrate. This might mean you can increase your contributions for the rest of the year. Or, "if you're encountering unplanned expenses right now, consider freeing up some money by allocating a bit less for retirement."

Finally, take a look at whether "you are contributing enough money to your 401(k) plan or workplace retirement plan to get the company's matching contribution," said CNBC — after all, "you don't want to leave that free money on the table."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

The week's best photos

The week's best photosA helping hand, a rare dolphin and more

By Anahi Valenzuela, The Week US Published

-

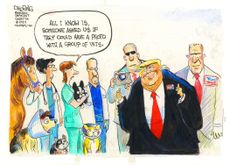

Today's political cartoons - August 30, 2024

Today's political cartoons - August 30, 2024Cartoons Friday's cartoons - seasoned vets, football season, and more

By The Week US Published

-

'Harris gains slim lead'

'Harris gains slim lead'Today's Newspapers A roundup of the headlines from the US front pages

By The Week Staff Published

-

A beginner's guide to passive income

A beginner's guide to passive incomeThe Explainer Smart ideas for making money with low-maintenance investments

By Becca Stanek, The Week US Published

-

The financial impact of returning to work in later life – should you 'unretire'?

The financial impact of returning to work in later life – should you 'unretire'?The Explainer Many people return to the workplace after retirement age, but what could it mean for your finances?

By Marc Shoffman, The Week UK Published

-

When will America's rental prices come down?

When will America's rental prices come down?feature Things may finally be cooling off

By Becca Stanek, The Week US Published

-

When is the best time of year to buy a car? For new cars, it's coming up.

When is the best time of year to buy a car? For new cars, it's coming up.The Explainer There are certain times within the month or even on certain days of the week that can help you score a more competitive deal

By Becca Stanek, The Week US Published

-

4 tips to keep your emotions out of investing

4 tips to keep your emotions out of investingThe explainer It's normal to feel worried about dips in stock prices or excited about an investment opportunity — but do not let it cloud your judgement

By Becca Stanek, The Week US Published

-

What is early direct deposit and how does it work?

What is early direct deposit and how does it work?The explainer Next time you are in a financial pinch, this option can get you early access to your paycheck

By Becca Stanek, The Week US Published

-

When does it make sense to refinance your mortgage?

When does it make sense to refinance your mortgage?The explainer You may be able to secure a lower interest rate — but it's not a good move for everyone

By Becca Stanek, The Week US Published

-

Are you entitled to compensation if your flight is delayed or canceled?

Are you entitled to compensation if your flight is delayed or canceled?The explainer New rules will soon require airlines to issue automatic refunds for canceled flights

By Becca Stanek, The Week US Published