Is Tesla finally in real financial trouble?

Elon Musk's once-dominant electric vehicle company is facing falling profits and unfulfilled promises of future advances

2023 was a high point of sorts for Tesla Inc. Just two years after becoming the first trillion-dollar automaker in history, the crown jewel of billionaire Elon Musk's tech empire saw its Model Y line supplant Toyota's RAV4s and Corollas as the best selling cars on Earth. That Tesla has become a juggernaut in not only the electric vehicle field but the automotive industry at-large in less than two decades after its first car rolled off the assembly line is undeniable.

Similarly undeniable, though, are the struggles Tesla has faced recently. Increased competition in the market coupled with recalls, rollout challenges and a renewed focus on CEO Musk's personal and political output have contributed to a newfound sense that a brand once virtually synonymous with electric vehicles may not have the horsepower it once enjoyed. Tesla stock last week tumbled after the company's second-quarter profit dropped more than 40% from the previous year. The drop is a "stark contrast for a company that grew to become the world's most valuable automaker on surging sales and profitability," CNN said.

While peaks and valleys are common for any company — particularly one in a still-relatively-cutting-edge field like Tesla — observers and analysts are split on whether the automaker now faces serious financial threats after dominating its field for so long.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

'Only a short-term issue'

"Bullish" analysts are "optimistic about future efforts such as Tesla's planned autonomous 'robotaxis' and updates to its self-driving software," Investopedia said. "Sequential fluctuations in automotive gross margin hardly warrant mention, in the context of Tesla's wider ambition" of artificial intelligence products and autonomous commercial vehicles, analyst Alexander Potter of investment bankers Piper Sandler said to Marketwatch.

Already, those "wider" ambitions meant that "not all Tesla's news was bad," The Motley Fool stock analyst Rich Smith said. The company's "energy generation (i.e., solar panels) and storage (i.e., batteries) division — which believe it or not is now more profitable (with an 18.9% gross profit margin) than the automotive business, doubled in size to $1.5 billion in sales," Smith said.

In part, Tesla's struggles represent the natural crowding of a field in which the company was, at one time, the sole major player. To that end, Musk himself "disparaged the quality of EVs from other automakers now in the market" to Tesla investors after last week's disappointing earnings statement, CNN said. Ultimately, Musk expressed that the market crowding "posed only a short-term issue for Tesla, not a long-term issue."

Tesla "remains very well positioned longer term" said Stifel analyst Stephen Gengaro to Market Insider. The company's robotaxi projects and fully autonomous driving vehicles mean it is teed up for "robust multi-year growth" for the next several years.

'Investors are right to be confused. And nervous.'

This was Tesla's "second straight quarter of year-over-year sales declines for the company" and its "first-ever consecutive quarters of declining sales volume," CNN said. The only precedent for this type of decline for Tesla "came early in the pandemic, when stay-at-home orders forced its factories to close."

Musk "stammered throughout the Tesla earnings conference call" last week and said he would be "shocked" if full, unsupervised full-self driving did not happen this year, Investor's Business Daily said. "The Tesla CEO has said for almost a decade that full autonomy would likely happen 'this year.'" Musk's robotaxi initiative "relies on self-driving technology Musk has long promised but repeatedly failed to deliver," said Motortrend this past spring. Previous successes notwithstanding, Tesla's road ahead "looks littered with potholes" to the point where "investors are right to be confused. And nervous." Factors like Tesla's susceptibility to "fluctuating" demand for EVs at large and China's aggressive ascendency in the global car market means the company might be in "real danger of slipping from top dog to scrappy underdog."

For as much as there is much "talk about robotaxis, humanoid robots and autonomous driving" — all things which provide "an exciting narrative for investors,— the fact remains that "these are tomorrow's potential riches," AJ Bell analyst Dan Coatsworth said to Reuters. "Not today's."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Rafi Schwartz has worked as a politics writer at The Week since 2022, where he covers elections, Congress and the White House. He was previously a contributing writer with Mic focusing largely on politics, a senior writer with Splinter News, a staff writer for Fusion's news lab, and the managing editor of Heeb Magazine, a Jewish life and culture publication. Rafi's work has appeared in Rolling Stone, GOOD and The Forward, among others.

-

The week's best photos

The week's best photosA helping hand, a rare dolphin and more

By Anahi Valenzuela, The Week US Published

-

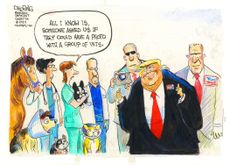

Today's political cartoons - August 30, 2024

Today's political cartoons - August 30, 2024Cartoons Friday's cartoons - seasoned vets, football season, and more

By The Week US Published

-

'Harris gains slim lead'

'Harris gains slim lead'Today's Newspapers A roundup of the headlines from the US front pages

By The Week Staff Published

-

Luxe landlords: High-end brands are moving into real estate

Luxe landlords: High-end brands are moving into real estateUnder the Radar Luxury brands are investing in both commercial and residential property.

By Justin Klawans, The Week US Published

-

Can Starbucks' new CEO revive the company?

Can Starbucks' new CEO revive the company?Today's Big Question Brian Niccol has been the CEO of Chipotle since 2018 but is now moving to the coffee chain

By Justin Klawans, The Week US Published

-

Donald Trump's bitcoin obsession

Donald Trump's bitcoin obsessionThe Explainer Former president's crypto conversion a 'classic Trumpian transactional relationship', partly driven by ego-boosting NFTs

By The Week UK Published

-

Would Trump's tariff proposals lift the US economy or break it?

Would Trump's tariff proposals lift the US economy or break it?Talking Points Economists say fees would raise prices for American families

By Joel Mathis, The Week US Published

-

It's not your imagination — restaurant reservations are becoming harder to get

It's not your imagination — restaurant reservations are becoming harder to getIn the Spotlight Bots, scalpers and even credit card companies are making reservations a rare commodity

By Justin Klawans, The Week US Published

-

The big deal: Why are fast-food chains suddenly offering discounts?

The big deal: Why are fast-food chains suddenly offering discounts?Today's Big Question After inflation and price hikes, a need to bring customers back

By Joel Mathis, The Week US Published

-

Retail media is seeing a surge this year

Retail media is seeing a surge this yearThe Explainer Amazon now makes more money from advertising than Coca-Cola's global revenue

By Justin Klawans, The Week US Published

-

Tesla investors back Musk's $48B payday

Tesla investors back Musk's $48B paydaySpeed Read The company's shareholders approved a controversial compensation package for CEO Elon Musk

By Peter Weber, The Week US Published